Wealth Management Fundamentals Explained

The Best Strategy To Use For Wealth Management

Table of ContentsAll about Wealth ManagementNot known Facts About Wealth ManagementThe Main Principles Of Wealth Management Wealth Management Can Be Fun For EveryoneWealth Management Can Be Fun For Anyone

You desire to make certain that your household can endure monetarily without pulling from retirement financial savings ought to something occur to you. As you age, your financial investment accounts need to end up being more conventional - wealth management. While time is going out to conserve for people at this stage of retirement preparation, there are a couple of benefits.And it's never too late to establish up and also add to a 401( k) or an IRA. One benefit of this retirement drawing board is catch-up payments. From age 50 on, you can add an additional $1,000 a year to your typical or Roth IRA as well as an extra $7,500 a year to your 401( k) in 2023 (up from $6,500 for 2022).

Deposit slips (CDs), blue-chip stocks, or certain realty investments (like a holiday home that you rent out) may be fairly secure means to add to your savings. You can likewise start to obtain a sense of what your Social Safety and security benefits will be as well as at what age it makes good sense to start taking them. wealth management.

, which will assist cover the costs of a nursing home or residence treatment must you need it in your sophisticated years. If you don't appropriately plan for health-related costs, especially unforeseen ones, they can decimate your savings.

10 Easy Facts About Wealth Management Shown

It thinks about your complete economic image. For a lot of Americans, the solitary biggest property they own is their house. Exactly how does that suit your retirement? A house was considered an asset in the past, yet considering that the real estate market crash, coordinators see it as less of an asset than they as soon as did.

.png)

There might also be modifications coming down the pipe in Congress relating to inheritance tax, as the inheritance tax quantity is arranged to go down to $5 million in 2026. When you reach retirement age and begin taking circulations, read this post here tax obligations become a big trouble. Many of your retirement accounts are tired as common income tax obligation.

Examine This Report on Wealth Management

Age comes with increased medical expenses, and also you will certainly need to browse the often-complicated Medicare system. Many individuals feel that common Medicare does not provide appropriate insurance coverage, so they seek to a Medicare Benefit or Medigap policy to supplement it. There's additionally life insurance policy and long-lasting care insurance policy to consider. One more kind of plan issued by an insurance coverage company is an annuity.

You put money on down payment with an insurance business that later on pays you an established monthly amount. Retirement preparation isn't difficult.

That's This Site due to the fact that your financial investments expand over time by making passion. Retirement planning allows you to sock away adequate money to keep the same way of living you currently have.

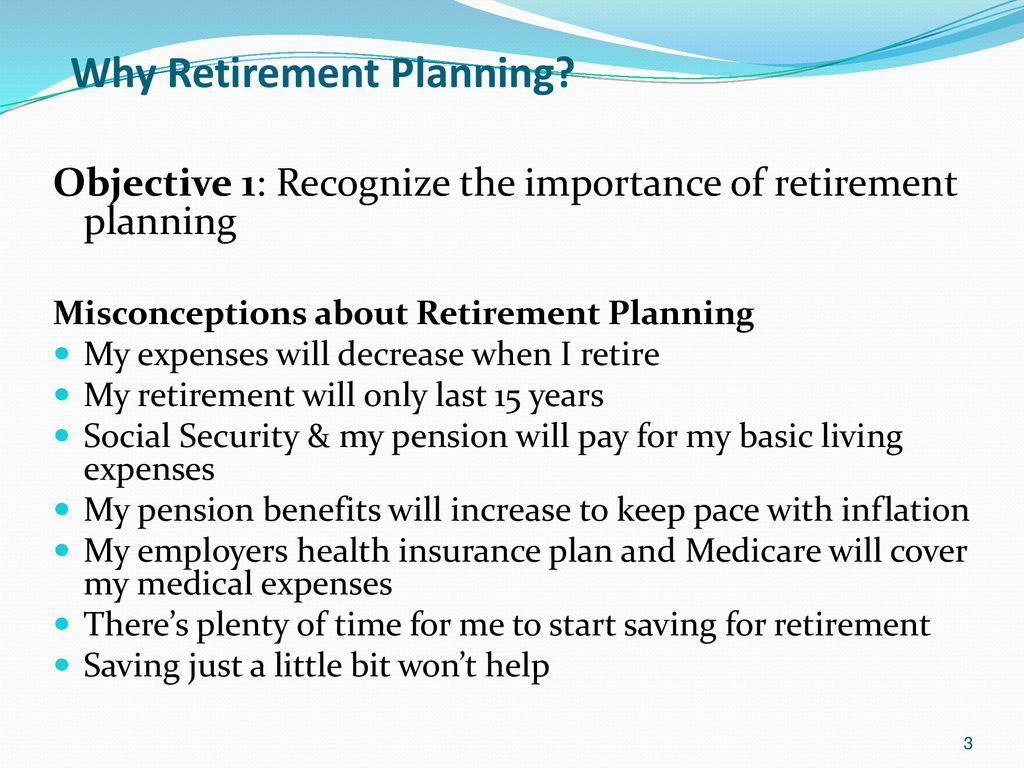

That's where retired life planning comes into play. And also it doesn't matter at which factor you are in your life.

9 Easy Facts About Wealth Management Described

We have produced a step-by-step overview that can assist you intend your retired life. Many investment options can help you save for retirement. Some options may attract higher dangers; others might help you safeguard your wealth. We understand that expanding your cash safely is necessary. This is why we have created retirement plans that match your needs.

It is very important to have a reserve to rely upon. This can aid you in your hour of requirement and cover the prices of unexpected expenses. When spending your money, make certain that you save sufficiently for any unanticipated financial needs. Life insurance policy can secure your loved ones with a safety monetary safety in your absence.

When getting ready for the future, try to pick different sorts of investment alternatives that put your money in differing property classes, sectors, and fields. This method, if you endure a loss in right here one investment or if one alternative does not perform per your assumptions, you can count on the others.

If you wish to work out in a brand-new city, your monthly expenses might be greater, depending on the city. If you like to travel, you may spend much more on travel costs in retired life than somebody who favors being at home. Your desires can aid you pick a suitable plan that can produce sufficient returns.

10 Simple Techniques For Wealth Management

Retired life strategies normally permit you to pick the costs you desire to pay towards your plan, as per your requirements. A greater premium may lead to a higher income throughout your retired life.